Rpgt Retention Sum 2019

The most recent rpgt amendment to be implemented in 2019 will be the seventh one so far.

Rpgt retention sum 2019. According to a statement by finance minister lim guan eng today the rpgt exemption effective from jan 1 2019 are for the disposal of properties including low cost houses low medium cost houses. First introduced in 1995 the latest iteration of rpgt rates in 2019 are expected to dampen soaring prices with a tax imposed on any profit made from the sale or disposal in financial parlance of a property. Where there is an allowable loss tax relief is allowed to the seller for that year of assessment in an amount equal to the sum arrived at by applying the table above. Pursuant to section 21b of rpgt act a retention sum of 3 from the disposal price shall be.

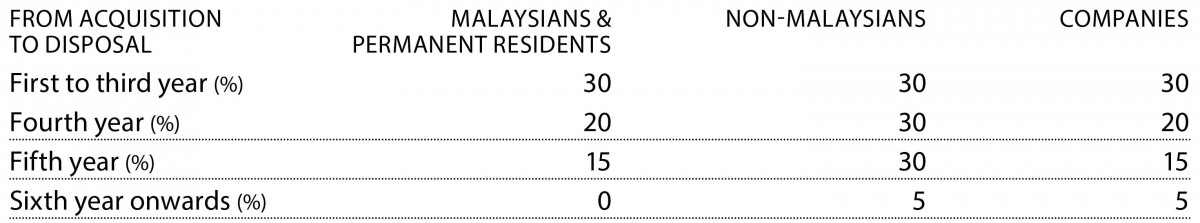

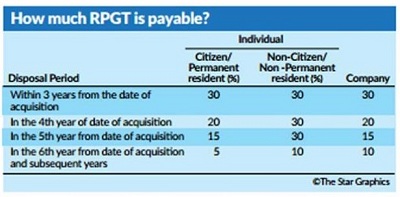

Rpgt rate table effective from 01 01 2019 individual citizen permanent resident company individual. Now there s about to be another revision to the rpgt for 2020. As you can see from the above rpgt rates from the 6th year onwards have increased to twice the existing rates for all the 3 tiers. Since the purchaser is required to remit the retention sum to the inland revenue board within 60 days from the date of the disposal 5 and the balance of the purchase price is usually only payable within 90 days retention for the purposes of rpgt is typically made out of the amount of the deposit.

Now here is some history about the rpgt. New rpgt rates from 1 january 2019. During the execution of the sale purchase agreement subject to rpgt is there any retention sum to be submitted to lhdn. Kuala lumpur dec 30.

The government has agreed to exempt the real property gains tax rpgt to malaysian citizens who dispose of their properties at a consideration price of rm200 000 and below. When is rpgt applicable. In 2014 the rpgt was increased for the fifth straight year since 2009. It was suspended temporarily in april 2007 to december 2009 and reintroduced in 2010.

Real property gains tax rpgt pursuant to real property gains tax act 1976. Below are the rpgt rates for each of the 3 tiers for your perusal. When can i get a refund. Your disposal year will be in the fourth year which falls under 20 rate.

That means it is payable by the seller of a property when the resale price is higher than the purchase price. The real property gains tax rpgt in malaysia is definitely not a new subject for property owners veteran investors especially. 5 hike in real property gain tax rpgt in malaysia 2019 november 3 2018 79 comments by ian tai by now most of us have a broad picture of belanjawan 2019 its highlights and perhaps have an opinion or two on who might be its victors and victims. Fast forward to 2019 the rpgt rates have been revised.

With this amendment foreign. If the 3 retention sum paid by the seller to irb is in excess of the rpgt payable then the irb must refund the seller the excess amount.