Sspn Tax Relief 2018

Sila tutup pop up blocker pada pelayan web anda sebelum membuat simpanan.

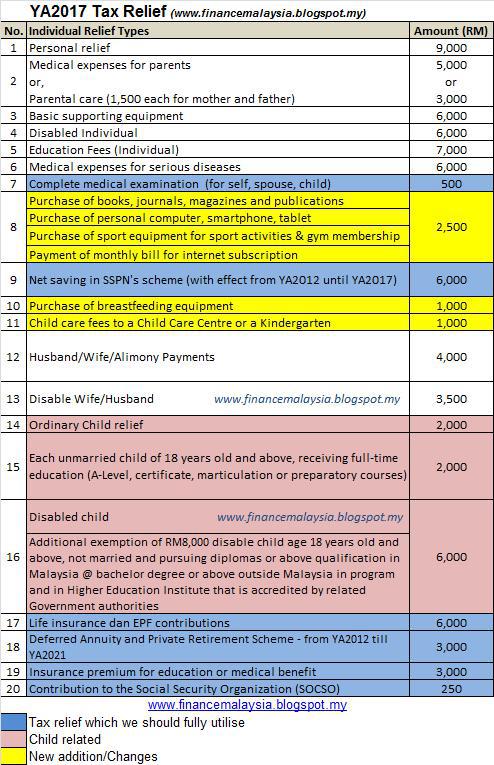

Sspn tax relief 2018. Individual and dependent relatives. Sep 21 2020 what is skim simpanan pendidikan nasional sspn. If you have deposited money into your sspn account in 2018 then this amount can be claimed in your e be form as well. This means that the maximum tax relief from sspn i new deposits will remain as rm6 000 until assessment year 2020.

Panduan adalah dlm format adobe acrobat pdf. Child care fees to a child care centre or a kindergarten. As you file your tax you should make sure you know your tax relief for 2018. Net saving in sspn s scheme total deposit in year 2018 minus total withdrawal in year 2018 6 000 limited 11.

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. Klik di sini untuk mengetahui panduan membuat penambahan deposit melalui e sspn i. Sspn national education savings scheme is a savings scheme for higher education launched in 2004. It should be calculated as the total deposit in the year 2018 minus total withdrawal in the year 2018.

Net saving in sspn s scheme total deposit in year 2018 minus total withdrawal in year 2018 rm6 000. The national education savings scheme sspn i was designed by the national higher education fund corporation ptptn for the purpose of higher education. Ibu bapa dan ibu bapa angkat penjaga yang sah dari segi undang undang yang menyimpan dalam akaun sspn i untuk manfaat anak diberi pelepasan sehingga maksimum rm8 000 00 setahun tertakluk kepada jumlah simpanan bersih tahun semasa. Should i invest in sspn i previously known as sspn1m for my child s higher education.

Tax relief for resident individual. Now the good news is national budget 2018 announced on 27 october 2017 has further extended this sspn i maximum rm6 000 tax relief period for another 3 years which will continue from assessment year 2018 until 2020. For ya 2012 to 2017 resident individuals have been eligible for tax relief of up to myr 6 000 for net savings in the sspn. As announced in budget 2013 it is proposed that personal tax relief for saving deposits placed with sspn i for the benefit of their children be increased from existing rm3 000 to rm6 000 effective from year of assessment 2012 to 2017.

Pelepasan taksiran cukai pendapatan ke atas simpanan sspn i. To further encourage savings for the purpose of financing the tertiary education of children the 2018 budget would extend the relief for another three years to ya 2018 to 2020. Amount rm 1. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too.

If case if you are a noob. Year of assessment 2019. However any amount that is withdrawn after your first deposit in 2018 is not counted. Sspn was introduced by the.